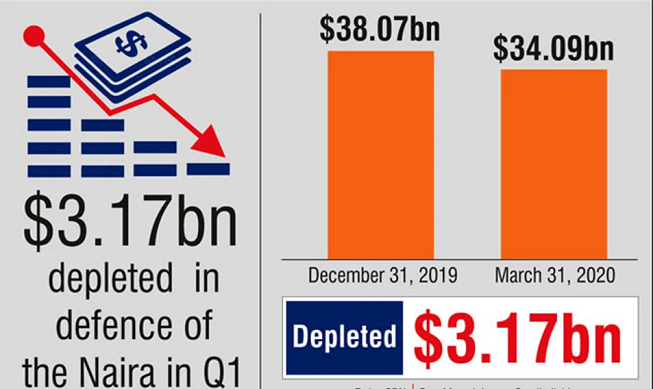

CBN Naira Defence Depletes Foreign Reserves By $3.17bn

Nigeria’s foreign reserves, which stood at $38.07bn at the end of 2019 fell to $34.9bn at the end of the first quarter of 2020.

To make forex available to operators in the economy, the Central Bank of Nigeria sold forex from the country’s foreign reserves to achieve stability of the exchange rate and provide liquidity despite the low revenue from oil sales.

During the last Monetary Policy Meeting, the Central Bank Governor, Godwin Emefiele, said, “External reserves position stood at $34.9bn in March 2020 as against $38.07bn in December 2019.

The depletion in external reserves was driven by FX sales to Bureau De Changes and Import & Export window as well as dwindling oil receipt.

The current level of reserves is estimated to finance about 6.30 months of imports.

Consequently, he said, the value of the naira at the I&E window was readjusted by 4.53 per cent to N380/$1 on March 20, 2020 from N363.53/$1 as of the end- December 2019, and at the BDC window by 5.48 per cent to N380/$1 from N360.25/$1 at the end of December 2019.

The CBN had technically devalued the naira after all interventions in the market such as imposing sanctions on errant operators and use of moral suasion to curb illegal forex operations did not sustain the exchange rate.

For about three years, the CBN had stabilised the exchange rate of the naira to the dollar, as the naira sold for N360/$1 in the parallel market until the oil price started to fall in the international market, leading to speculations and hoarding of forex.

As forex scarcity persisted, the CBN suspended the sale of forex at the end of March but resumed partial sales at the end of April.

Crude oil price which closed at $60 per barrel at the end of 2019, plunged to $25 in May after it had sold for lower than $20 in recent weeks.

This led to the dollar exchanging to the Naira between N420 and N450.

The President, Association of Bureaux De Change Operators of Nigeria, Aminu Gwadabe, had said the movement was as a result of recklessness on the side of speculative operators.

He said there was no reason for the speculation because the apex bank had continued to support the liquidity of the BDC subsector.

According to him, the merger of the different rates became necessary to build confidence in the sector.

Gwadabe noted that this would make it impossible for those dealing in illegal operations and speculators to be profitable.

He said the rise in the exchange rate was not due to genuine demand because people were not really travelling or importing goods during the period of the lockdown arising from CIVID-19 pandemic.

The situation cannot remain like this; things will improve. If coronavirus goes, we will get over it,

he said.

However, the foreign reserves which had been declining for many months returned to a growth path in May 2020.

CBN’s report showed that the foreign reserves rose by $1.22bn from $33.42bn as of April 29 to $34.65bn on May 11.

During the last MPC meeting, the Bankers’ Committee reiterated the need for government to urgently reduce reliance on oil revenue by gradually diversifying the economy and improving tax collection.

On the domestic front, the committee stated that available data on key macroeconomic variables indicated the likelihood of subdued output growth for the Nigerian economy in 2020.

Emefiele, who chaired the MPC meeting, said,

Based on the current downturn in oil prices, staff projections indicate that output in 2020 would be less than earlier envisaged.

The major downside risks to this outlook, however, include the continued spread of COVID-19; further decline in crude oil prices and the reduction in accretion to external reserves; reduced government revenue leading to weak aggregate demand; declining non-oil receipts; as well as infrastructural and security challenges.

The committee stated that the headwinds would, however, be partly mitigated by the timely and effective response of the monetary and fiscal authorities in containing the spread of the COVID-19 infection, and the recalibration as well as adjustment of the 2020 federal budget to the revised thresholds.

It emphasised pegging expenditure to critical sectors of the economy, adoption of a new fiscal regime to encourage the build-up of fiscal buffers; sustained CBN interventions in selected sectors; and enhanced flow of credit to the real sector and deliberate policies to diversify the economy.

The International Monetary Fund (IMF) had stated that the sharp fall in international oil prices, together with reduced global demand for oil, was worsening Nigeria’s fiscal and external positions.

The country’s oil exports are expected to fall by more than $26bn,

it stated

The economy which remained highly reliant on foreign exchange proceeds and the recycling of petrodollars was expected to contract by about 3.4 per cent this year, a six percentage point drop compared to pre-COVID-19 projections, the IMF stated.

It also stated,

With the decline in economic activity, large fiscal and external financing gaps have emerged.

Our baseline scenario is uncertain and subject to heightened risks.

These are mostly linked to a further collapse in oil revenue – due to persistent low oil prices, an inability to sell oil because of depressed global demand, or declining production because of additional OPEC-agreed cuts.

Source: Punch

Justin Nwosu is the founder and publisher of Flavision. His core interest is in writing unbiased news about Nigeria in particular and Africa in general. He’s a strong adherent of investigative journalism, with a bent on exposing corruption, abuse of power and societal ills.